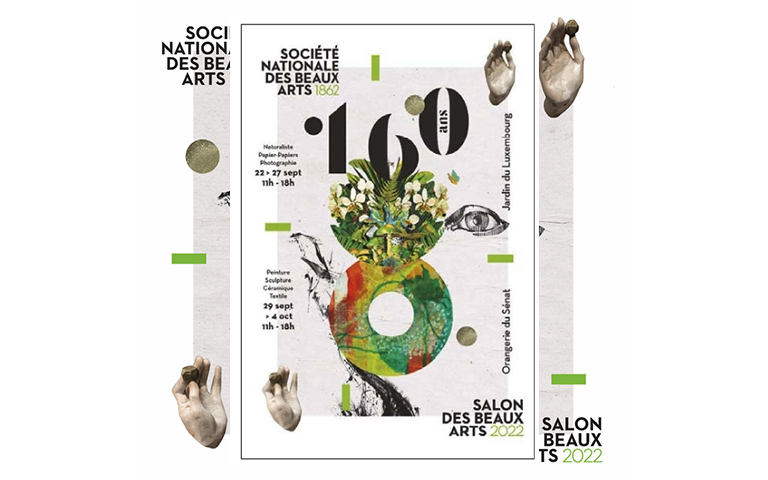

The firm was very happy to be present at the opening of the Salon des Beaux-Arts 2022. A highlight by the quality of the works but also by the announcement made by Michel Kling, president to wish to transform the SNBA, into a recognized Foundation of public utility.

On the occasion of the opening, Stéphanie Brossé-Verbiest, Managing Director of the firm, was able to thank the Board of Directors of the SNBA, Michel Kling its President and Isabelle Lawson, Executive Director for their confidence in the firm Ginestié Magellan Paley-Vincent for support them in their project of transformation into a Foundation recognized as being of public utility.

After 160 years of existence, the SNBA is still a little more committed to artists by working on the sustainability of its legal structure. For this, it has chosen the firm Ginestié Magellan Paley-Vincent, which accompanies it Pro Bono in its transformation into a Foundation recognized as being of public utility.

Philippe Ginestié and Fabienne Kerebel, experts in the legal life of non-profit organizations (Azzedine Alaïa Foundation, Les Artistes de l'Opéra Hors les Murs, Alpha&Omega, etc.) advise them on their project.

We invite you to visit until October 4 at the Luxembourg Garden to admire the works selected for the 2022 Salon.

More: http://www.salondesbeauxarts.com/exposer/invitations-salon-2022/

Philippe Ginestié

Founder

Founder of the firm, he has extensive experience in the areas of corporate and complex operations where legal, tax and financial considerations must be integrated. He has developed particular expertise in the legal organization of relations between the control of power in groups.

Administrator of the Alpha Omega Foundation, he also supports non-profit organizations.

Fabienne Kerebel

Counsel

She has acquired a solid expertise in the law of listed and unlisted companies and its various components, in particular private equity and mergers and acquisitions.

As such, Fabienne advises companies and executives on their external growth operations, changes in their governance or shareholding, the incentive of key managers or the reorganization of corporate structures. She has developed an in-depth practice of financial securities transactions which allows her to support start-ups, SMEs and mid-cap companies in their fundraising as well as investors at all stages of their investment.